Old vs New Tax Regime: Which One Should You Choose If You Earn Above Rs 12.75 Lakh?

If your income is over Rs 12.75 lakh, you might be wondering whether you should stick with the old tax regime or opt for the new one, which offers lower tax rates but fewer deductions. Here’s a simple breakdown to help you decide.

When to Choose the New Tax Regime:

The new tax regime is ideal if:

1. Your income is Rs 12 lakh or less, as you can get a full rebate under Section 87A.

2. You don’t have many tax-saving deductions, such as contributions to Provident Fund (PF), Public Provident Fund (PPF), life insurance, or home loan principal repayment.

When to Choose the Old Tax Regime:

The old tax regime works better if you can claim a lot of deductions. Some of these include:

1. Section 80C: Deductions for PF, PPF, life insurance premiums, or home loan principal repayments.

2. Section 80D: Medical insurance premiums for you and your family.

3. House Rent Allowance (HRA) and Leave Travel Allowance (LTA).

4. Home loan interest deductions.

The old tax regime allows you to lower your taxable income significantly by using these deductions. However, it’s only worth sticking with the old regime if your total deductions are higher than the threshold for your income level.

Which Tax Regime Should You Choose?

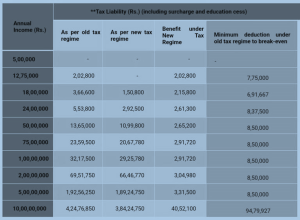

• High deduction claimers: If your deductions are more than Rs 8.5 lakh, stick with the old tax regime for maximum tax benefit.

• Lower deduction claimers: If you don’t have many deductions, the new tax regime is better, as it has lower tax rates and less paperwork.

• Salaried individuals: Don’t forget that the new tax regime offers a standard deduction of Rs 75,000, which the old regime doesn’t.

Ultimately, the decision between the two tax regimes should depend on your individual financial situation and tax-saving strategies. It’s a good idea to consult a tax expert or chartered accountant (CA) to figure out the best option based on your income, deductions, and long-term financial goals. Below is the table for you reference .